Since launching in 2007, Real Ventures has invested in and supported more than 250 companies and grown a network of 750+ portfolio founders. During that time, we have raised five funds, built Canada’s longest-running accelerator, FounderFuel, and helped launch Front Row Ventures, our student-focused fund.

Working with so many founders across the early stage spectrum has given us a unique window into how founders succeed. Over time, some clear patterns have emerged. Over the last few years, we have collected some of those patterns into our Playbook — a set of “Plays” that we have found to be critical for long-term, sustainable success in rapidly scaling businesses. Like the plays that sports teams run, these Plays take focus, practice, and discipline. But when implemented consistently and rigorously, they provide a strong foundation for company building and greatly increase the odds of long-term success.

In this post, we are sharing a high-level overview of the first eight Plays in the Real Ventures Playbook and specific actions that founders can take to implement each Play. In the months that follow, we will illustrate each Play with a post that highlights a Real Ventures portfolio company that embodies that Play.

Play 1: Adopt a “Growth Mindset”

For companies to scale successfully, founders must scale themselves along with their company. The first step on this journey is developing an awareness of oneself and one’s surroundings. Awareness includes an understanding of one’s strengths and weaknesses and how one deals with emotion, conflict, and stress. Through awareness and a “growth mindset,” a founder can prepare herself emotionally and mentally for the big changes to come.

Play 2: Establish first principles

First principles are the core beliefs of an organization — its mission, vision and values. First principles are crucial for driving alignment. Founders who are explicit and vocal in communicating their authentic vision and mission empower their team and make what they are about clear to the world. Similarly, creating clarity around values can inform every aspect of company culture — from hiring practices and conducting performance assessments to supplier relations and strategic decision-making.

Actions founders can take now to establish first principles:

Align on the answers to these foundational questions:

- Why does the company exist?

- What is it accomplishing?

- How should people work?

Revise the organization’s mission and vision statements.

- Are they authentic to the mindset of the founders?

- Are they open to evolution as the company develops?

Revise the organization’s values.

- Do they accurately reflect how people are expected to work together? With clients? With vendors?

- Are they reflected in the organization’s processes?

Assess how clearly and how frequently first principles are communicated both internally and externally.

- Number of communications channels leveraged.

- Adoption starts with leadership. Founders should be communicating first principles frequently with their teams.

For more on how we think about mission and vision, check out this post.

Play 3: Think strategically

Venture scale outcomes occur when companies develop a sustainable advantage that allows them to fend off competitors. The stronger a company’s edge, the deeper the moat around the business. To identify advantages, it’s imperative that founders master strategic thinking, develop a thorough understanding of their competitive landscape, identify the paths to take to drive their competitive advantage, and find a unique and durable positioning with respect to competitors. Once strategies are established, startups should remain vigilant, continually reassessing their unique value proposition as it relates to their competitors and the larger value chain, and be ready to pivot when necessary.

Actions founders can take now to refine their strategic thinking:

- Build a comprehensive competitors list and update it regularly. This list should include as much information as possible about each competitor, such as their offering, when they were founded, their value propositions, weaknesses, current clients, etc. This exercise will prove helpful in better understanding the competition. It will also provide founders with a bird’s eye view of the market and help identify service offering/market gaps to inform their strategy and pivot when needed.

- Learn about the different paths to strategic advantage (brand, network effects, IP, product, pricing, culture, essence, business model,…) to determine which advantages present the best strategy for their organization.

- Plan team sessions every quarter to reassess the organization’s unique value proposition.

Play 4: Model your milestones

Companies that hit their milestones have a much easier time raising further financing and progressing on the venture path. Thinking critically about milestones is therefore crucial to startup success.

Building an assumption-driven financial model enables founders to have hypothesis-based discussions with their teams and their board. By understanding key hypotheses (like the cost to acquire customers or the margin on a particular service) and building a hypothesis-driven financial model to track performance, founders will be clear on disproven hypotheses and unachievable milestones. This will enable them to manage costs better, extend their runway and adopt a financing plan in line with their results.

Actions founders can take now to model their milestones:

Build a financial model that:

- Is dynamically-linked and assumption-driven;

- Represents how the business works;

- Test different scenarios, and

- Predicts performance.

Play 5: Foster accountability

When accountability and ownership are clear, teams ship quickly, resolve issues effectively and maintain their motivation. The more accountable a culture is, the more likely it is to perform at a high level. Choose tools and set goals that match the sophistication of the company. Startups change quickly, so founders should regularly re-evaluate the systems they have in place, especially in times of significant growth.

Great employees love to take responsibility and ownership. Successful leaders recognize opportunities to increase accountability whenever they arise, whereas founders who try to do too much on their own often struggle to scale. By recognizing opportunities to increase accountability whenever they arise, founders will rapidly and successfully scale their companies.

Actions founders can take now to foster accountability:

Leverage established tools for creating a culture of accountability, such as:

- Goal setting tools like OKRs;

- Project management tools like RASCI to create alignment on specific projects;

- Org charts to clarify for everyone who does the work today and who will do it tomorrow;

- Adopting task management platforms (such as Asana, JIRA, Trello, or Basecamp) to streamline communication while clarifying ownership.

For more on our thinking about fostering accountability, check out this post.

Play 6: Partner with your investors

Investors can be great allies in company building. They can also be distractions, and in the worst case, investor relationships can sour. We recommend a partnership mindset built on trust and transparency to get the most out of your backers. Through regular open communication about the company and yourself and the structured and balanced use of your board as a crucible for your company, you will gain insights and support that only strengthen your company.

Actions founders can take now to build trust with their investors:

Maintain open, honest, and frequent communication with their investors by:

- Sharing reports to create a common ground for all stakeholders;

- Scheduling one on ones to problem solve and build a relationship;

- Leveraging board meetings for group discussion and decision-making.

Make the most out of their board meetings by:

- Preparing ahead: Deliver well-crafted board materials in advance, pre-brief board members on critical issues;

- Creating structure: Provide a well thought out agenda, good timekeeping, and accurate note-taking;

- Prioritizing high-value discussions: Strategic topics are the highest leverage use of the board;

- Balancing the voices at the table: Take steps to ensure that no one dominates the conversation and that everyone participates when appropriate;

- Following up: Keep a record of all actions that arise, follow up as appropriate, and deliver accurate minutes.

For more on our thoughts about partnering with your investors, check out this post.

Play 7: Craft a narrative

Strong narratives unlock opportunity. Just as your vision, mission, and values provide a foundation for internal alignment, a compelling narrative about what you are doing, why it matters, and how you will win is vital to unlocking investment, attracting team members, intriguing the world, and enticing acquirers.

A great narrative is easily grasped, compelling and shareable. Every startup narrative is unique. But in general, we find they always answer three questions: Why should I care? Why should I believe? Why should I join? The words are what matter most, so founders should start with tools that focus on the words until they get them right. For each section in the narrative, founders need to focus on making bold claims and defending them with convincing data.

Actions founders can take now to refine their organization’s narrative:

Ask team members to answer the following questions about the organization:

- Why should I care?

- Why should I believe?

- Why should I join?

Repeat the exercise, but replace the word “I” with the following groups:

- Customers

- Vendors/supplier

- VCs

- Employees

- The press

- Society

Afterward, host group discussions to see the patterns and themes that emerged during the exercise to understand the organization’s current narrative and whether it reflects the narrative founders aspire to tell.

For more on how we think about narrative, check out this post.

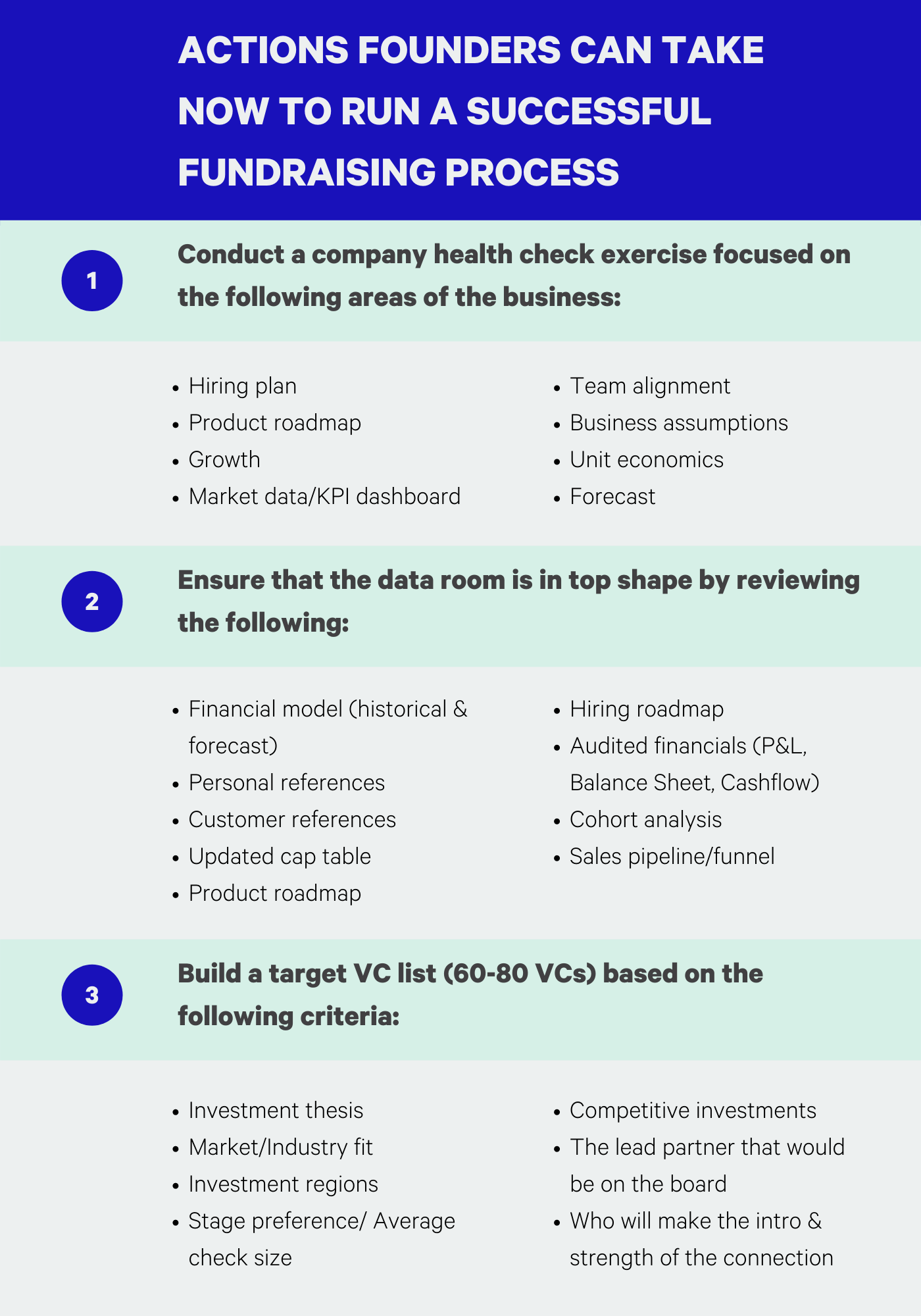

Play 8: Run a fundraising process

Fundraising is about momentum. A well-run fundraising process aims to create that momentum by developing high-quality materials and then reaching out systematically to well-qualified leads within a tight time frame. This process should be run even when founders already have inbound interest. They need to apply the same techniques they would with any sales effort: Develop strong collateral, build a robust pipeline, work the funnel intensely and close the deal.

Fundraising also requires intense focus from the CEO, who needs to respond quickly and communicate effectively across every discussion. To achieve this focus, they need support from the team for investor requests and additional operational workload.

By spending adequate time preparing the required materials, especially a strong deck and blurb, a thorough data room, and a well-researched investor list, founders are more likely to receive multiple offers and get the best terms to set themselves and their organization up for future success.

For more on running the fundraising process, check out these posts — preparing to raise, running your process, winning your meetings.

While there are certainly some companies that succeed without using these Plays, of all the companies we have backed, the ones that employ these Plays consistently and diligently have more positive experiences growing their companies, building support, and leading their teams. These Plays are not silver bullets; but they can provide an excellent foundation for long-term, sustainable success. Real Ventures is dedicated to supporting entrepreneurs and helping them scale themselves as well as their businesses. By sharing these Plays, we hope to help founders on their journeys to build game-changing companies.

**********

For more on our thoughts about how to scale your startup, sign up for our newsletter and follow us on Twitter, LinkedIn, and Facebook.