🎯 Register to attend the next Circle gathering, taking place on Tuesday, June 10, 2025: HERE.

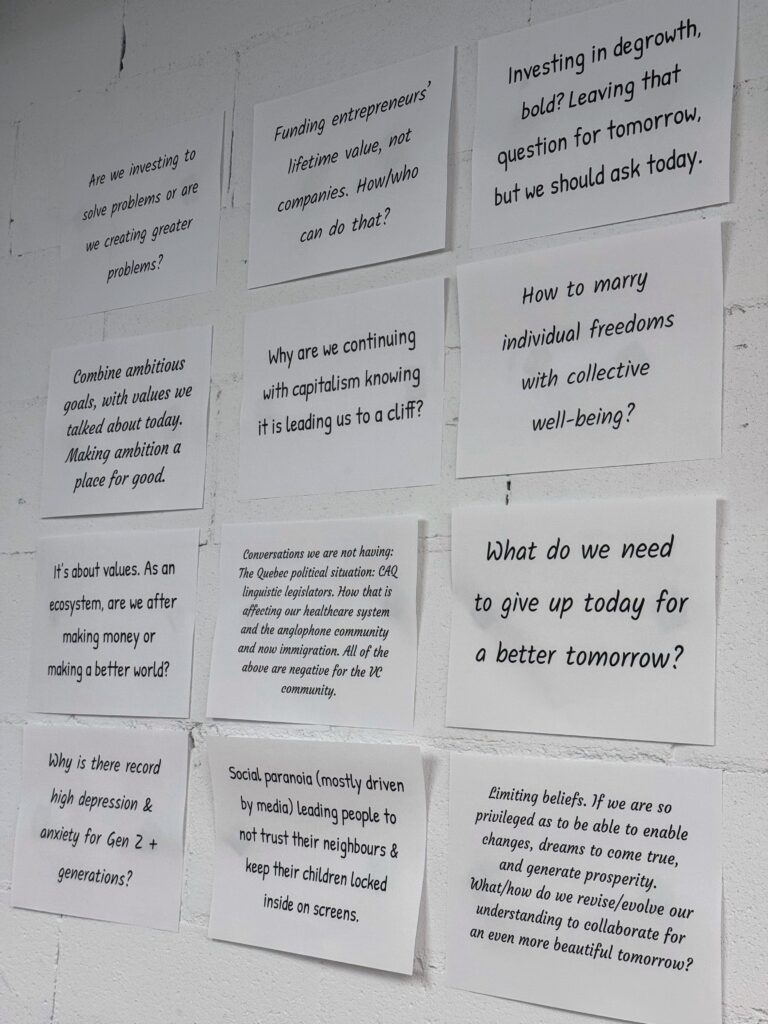

In September 2024, during our Annual Meeting, which gathered Real Ventures’ limited partners, founders, and members of the broader startup ecosystem, we asked a seemingly simple question: What are the questions we’re not daring to ask ourselves in the startup and investment ecosystems?

What came back was a powerful wave of truth. Candid. Thoughtful. Sometimes uncomfortable. And overwhelmingly human. These were not theoretical questions. They were rooted in lived experience and intuition. A longing for something different. For a startup world that feels more alive, more responsible, more inclusive, and more able to align around what people truly value.

That moment sparked something within our team. It revealed just how many members of the startup and investing community were craving deeper conversations. Not just about business models or funding rounds, but about values, assumptions, purpose, and the systems we’re all a part of. We realized we needed a new kind of space to hold those conversations.

That’s how The Circle came to be.

Stepping Into The Circle: What These Gatherings Are Really About

Each month, The Circle brings together a diverse group of founders, funders, and curious members of the startup ecosystem for an evening of reflection, dialogue, and shared discovery. These gatherings are intentionally loosely structured to allow for facilitated, open-ended dialogue. No panels, no pitches, and no one claiming to have all the answers. Instead, participants step into a space curated for listening, learning, and exploring meaningful questions together.

The format of each session blends large and small group conversation, personal reflection, and participatory tools like constellation exercises, polarity mapping, and framing exercises. These tools help us hold nuance and complexity while inviting people to see ideas and each other from new perspectives.

Over the course of the year, we’re exploring a range of interconnected themes that emerged directly from the community’s questions at the Annual Meeting:

- Rethinking growth and economic paradigms

- Expanding how we define and measure success

- Examining the societal and environmental impact of capital

- Reconnecting with human and personal values

- Exploring the power and influence of investors

- Deepening collaboration and inclusivity

- Understanding political and cultural dynamics

- Imagining systemic innovation

- What a viable future could truly look like

Each session builds on the last, forming an ongoing conversation about the overlapping systems we’re navigating, the assumptions we’re holding, and the future we want to co-create.

Here’s a glimpse into what’s unfolded so far.

February: The Questions We’re Not Daring to Ask

Our first Circle session was co-facilitated by John Stokes and Michelle Holliday, who helped open the evening with questions that went straight to the heart of our work. Participants were invited into a series of facilitated exercises designed to reveal not just individual perspectives, but the deeper narratives shaping our ecosystem.

We kicked the evening off by asking each person to name who or what they were here at this meeting in service of. The responses were diverse and personal, ranging from “my future grandchildren” to “I’m here to serve my curiosity” to “the human behind the startup.” One person shared, “I’m here to stop borrowing from the next generation.”

In small groups, we surfaced assumptions we rarely question: that growth is always good, that democracy is secure, that our value is tied to our productivity. The honesty in the room made space for deeper, more human connections. “Not one person asked me what I do for a living,” someone observed. “We were talking about values, purpose, futures we want to build. It was such a shift from the usual startup event.”

The evening closed with a reflection circle. What people shared wasn’t polished, it was real. One participant said, “ A good portion of tech startups are for more than optimizing growth. There are not a lot of spaces to support that. It was a privilege to be here.” Another added, “I discovered that big conversations with over 30 people work. We should have more of these.”

What became clear by the end of the night was that we had tapped into something powerful. We weren’t just talking about the startup ecosystem. We were beginning to reimagine it together.

March: Rethinking Growth and Economic Paradigms

In March, we explored a story that underpins much of the startup and investment world: the narrative of growth.

We asked: Do we really need fast-growing companies? What does sustainable, regenerative growth look like? And how do we know when growth is serving us and when it’s costing us?

The conversation was alive with nuance. Some argued that rapid growth can be positive if it’s in service of solving real problems. Others noted that nature offers lessons: what grows too fast often collapses. Growth, someone said, should be a vector toward value creation, not destruction.

A powerful moment came through a constellation exercise, where participants were invited to physically position themselves in the room based on their level of agreement or disagreement with the prompt: “Humanity absolutely needs fast-growing companies.” This created a visible spectrum of personal beliefs across the space. People moved toward the center if they strongly agreed, or toward the edges of the room if they didn’t agree with the statement. This made the room itself a map of perspectives, helping everyone see the diversity of thought in real time.

This physical mapping gave the group a shared reference point for the conversation that followed. Some people stood still and certain, while others hesitated, unsure of how they felt. “I debated where to stand,” one participant admitted. “It made me realize how many competing truths I hold.” The exercise helped shift the tone from abstract discussion to embodied understanding, highlighting where alignment existed and where further exploration was needed.

Building on the perspectives that surfaced in the constellation exercise, we moved into a new mode of exploration. In small groups, we invited participants to imagine what alternative economic stories might look and feel like. The insights that emerged were a blend of hope and despair. Some saw the need to “redefine human values” and to pursue evolution more than growth, while others voiced doubt about whether there is sufficient collective will to make such shifts.

In addition to questioning the role and purpose of growth, this observation seemed core: “What are we not willing to do in pursuit of whatever we’re pursuing? It’s OK if what we’re pursuing is money. But there’s currently no check on that. Something needs to change in order to determine as a society what boundaries we shouldn’t cross.”

As another observed: “What good is growth if we don’t have a flourishing society?”

April: Reassessing Metrics of Success within the Startup Ecosystem

In April, we turned our attention to the metrics that shape how we define success in the startup ecosystem and asked: What are the current success metrics in our startup and investing ecosystem? As we mapped out the most common metrics on the wall – funds raised, revenue, growth, exits, NPS, visibility, etc, we saw a pattern emerge. These were the metrics most commonly celebrated in our ecosystem. But many in the room began to voice that they didn’t reflect what they truly value and the reasons why entrepreneurs become entrepreneurs in the first place.

From there, we invited participants to reflect on the assumptions that sit beneath these metrics. Working in small groups, they surfaced beliefs like “startup enterprises are first and foremost economic enterprises,” “growth is proof of success,” and “if it’s not measured, it doesn’t exist.” The exercise challenged people to name the invisible narratives, the underlying assumptions, that shape so much of what we build and how we evaluate it. In addition to noticing that the metrics don’t match why people become entrepreneurs, one participant voiced the underlying feeling floating in the room following the exercises: “I feel sad”.

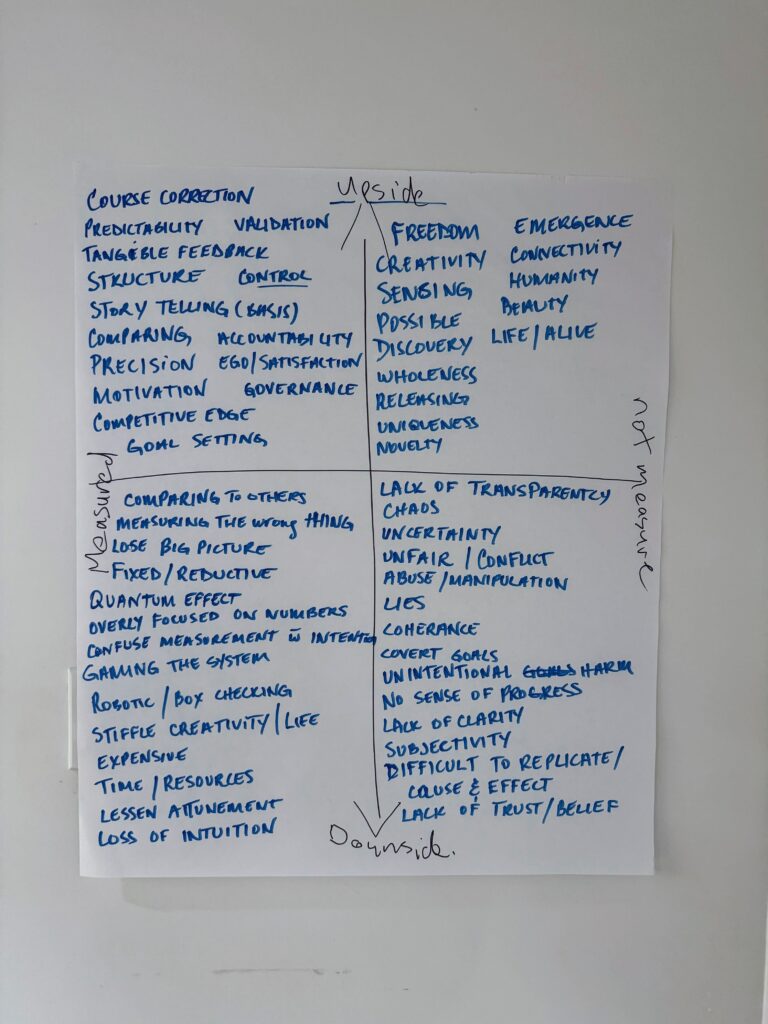

To explore these tensions further, we facilitated a polarity mapping exercise. Participants were asked to consider both the upsides and downsides of measuring and not measuring. The results revealed complexity across the board. Measurement can bring clarity, accountability, structure, and momentum. But it can also lead to rigidity, over-comparison, loss of intuition, and reductive thinking. Not measuring, on the other hand, can open space for freedom, emergence, and creative thinking. But it can also create confusion, uncertainty, and make it difficult to track progress.

The exercise surfaced something essential. It wasn’t about choosing whether to measure or not. It was about understanding the tension between the two and learning how to navigate that space with more awareness. The group began to see that success isn’t defined by one set of metrics, but by the ability to hold multiple truths at once: clarity and emergence, structure and spaciousness. It’s in striking that balance that new forms of value and insight become possible, blending the quantitative with qualitative, intuitive and holistic.

With this awareness, we shifted into a framing exercise designed to help us look at success from a completely different vantage point. We split into four groups and assigned each group a unique perspective: children, the St. Lawrence River, Hydro-Québec, and Canada. Each group was asked to answer the question, “How might the startup ecosystem take into account that perspective in our assessment of success?”

The insights that emerged were rich and unexpected. Some groups spoke about increasing biodiversity, others about positive community engagement, cultural regeneration, or energy equity. Many participants shared that the exercise freed them from the usual startup and investment narratives. It allowed them to think outside the confines of the metrics they were used to and consider new ways to understand success. It created the space to see the system from a new angle and gave them permission to imagine alternative models of success from the perspective of groups or entities that are massively impacted by startups and tech innovation but that have little power or say in what is considered success.

By the end of the evening, the conversation and energy in the room had shifted. We moved from talking about performance to talking about perspective and purpose. We weren’t just questioning how we measure success. We were beginning to imagine how to define it differently.

“I’m leaving feeling that this is good, this kind of thinking. Trying to think of success more holistically is comforting. Broadening the place from which you look made a huge difference.”

In all, the group voiced the current set of assumptions as a story – in many ways a limited, limiting story. And we stretched it by examining it, by exploring the potential for something more complete. The new possibilities we began to imagine felt more alive and more grounded in the things the group felt mattered most.

Why We’re Doing This

We believe the work of transformation isn’t just external. It’s internal, relational, and systemic. We’re not just looking to fund a different kind of startup. We want to be a different kind of investor. One that drives systemic change and that aligns profits with social cohesion and planetary well-being.

And that means creating the kinds of practice grounds for being, relating and thinking together in non-conventional ways where real change can start. “If entrepreneurs want to change the world,” as one participant observed,” we need to create different spaces. We’re not competing. We have competing ideas but the same goal.”

The Circle is part of that effort. It’s a community of learning and practice. A space to sit with complexity, to explore collective wisdom, and to reconnect with what matters most. We don’t expect to solve everything in any one three-hour session. But we do believe in the power of showing up, together, over time.

We believe these conversations are needed. Urgently and everywhere.

Next Up: The Societal and Environmental Impact of Capital

Our next gathering will take place on Tuesday, May 13th, 2025 where we’ll explore the role of capital in shaping society and the environment.

If you’re a founder, and especially an investor, who wants to explore these questions and maybe ask a few of your own, we’d love to have you with us. Your perspectives are important and needed in shaping our ecosystem.

This article was co-written by Lisa Séguin, Director of Operations at Real Ventures and Michelle Holliday, Founder of Thrivable World.

**********

For more on our thoughts on helping founders become wiser, faster, so they can build sustainable companies with global impact, sign up for our newsletter and follow us on LinkedIn and YouTube.